Optically, this revenue showed a massive deceleration from 39% y/y growth in Q4, but that's due to A) tougher comps from lapping Splunk's subscription transition and B) timing of contract renewals that disproportionately benefited the fourth quarter. Splunk's revenue grew 11% y/y to $751.5 million, beating Wall Street's expectations of $727.2 million (+8% y/y) by a three-point margin. Splunk Q1 results (Splunk Q1 earning deck) Let's now review Splunk's latest quarterly results in greater detail. Stay long here: I'd recommend holding a long-term position and wait to let go until Splunk hits the ~$120s, and selling puts on dips to capture short-term gains if desired. My updated year-end price target on Splunk is $121, representing a 5.5x EV/FY24 revenue multiple and 20% upside from current levels. This puts Splunk's valuation multiples at: Note as well that the company has also taken up its FCF guidance to $805-$825 million, representing a 21% FCF margin and >90% growth relative to just $427 million in FCF in FY23. Meanwhile, Splunk has guided to $3.90 billion in revenue, revising its range for the year to the upper end of its prior guidance and representing 7% y/y growth: At current share prices near $100, the company trades at a market cap of $16.72 billion, and after netting off the $2.51 billion of cash and $3.88 billion of debt on the company's most recent balance sheet, Splunk's resulting enterprise value is $18.09 billion. Splunk's valuation remains a core reason to be bullish on the stock. I see significant opportunity for Splunk to expand its presence outside of the U.S. Currently, only about ~35% of its revenue base comes from international markets (and an even smaller ~20% slice of the cloud business is overseas). Significant international expansion opportunity - Splunk has become a global brand name, and it's time for Splunk to chase more opportunities overseas.

These commendations don't come lightly to IT buyers when making a purchase decision.

#SPLUNK STOCK SOFTWARE#

Gartner, the software industry's leading analyst and reviewer, has bestowed the "Leader" designation to Splunk in the security information and event management space, and also named it as the vendor with the highest ability to execute. Industry-wide recognition - More to the point above, it's fine to have competition when Splunk also is widely considered the best-in-breed vendor for machine data analytics. We note as well that Splunk's ~$4 billion annual revenue scale makes it twice as large as its next-closest competitor, Datadog. Splunk focuses on visualizing and analyzing machine data (information passively generated by computers, phones, and other endpoints within networks). The company's closest large/public peers are the monitoring companies like Datadog ( DDOG) and New Relic ( NEWR), which primarily focus on monitoring the performance and uptime of applications and infrastructure.

It's also the largest company in the space. Splunk isn't without competitors, but the company's focus on machine data is unique.

#SPLUNK STOCK INSTALL#

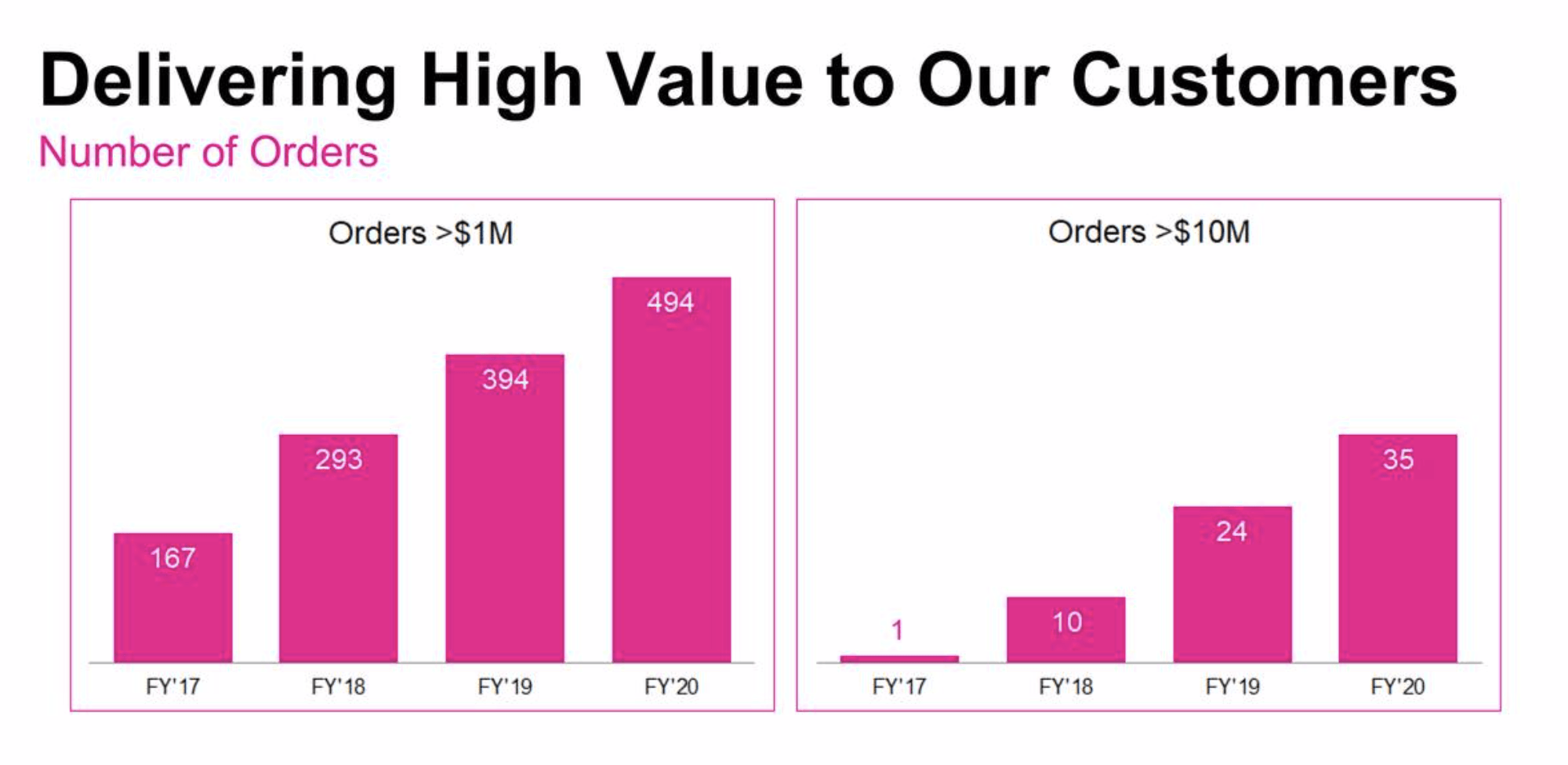

As data volumes continue to explode and companies push the boundaries of how they integrate data into operations and decision-making, Splunk has a tremendous opportunity to derive growth from within its install base. Splunk's platform is charged on a data volumes/computing power basis. Some of the most successful software stocks are usage-based, meaning that revenue climbs proportionally to a customer's usage of the product. But as Splunk has evolved, the company's machine data capabilities are applicable across virtually any industry and across many functions. In its early days, Splunk's machine data-mining capabilities were often used for security purposes to flag and respond to anomalies within corporate systems.

#SPLUNK STOCK FULL#

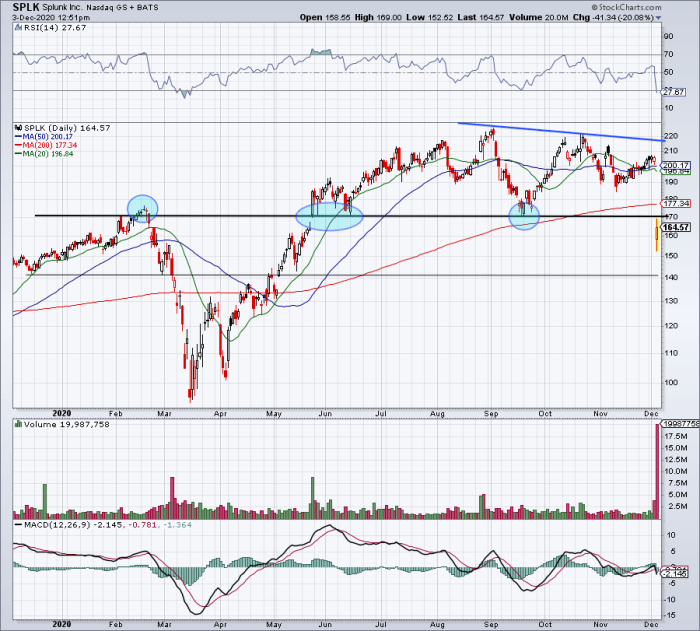

Here is the full long-term bull case for Splunk: In my view, the company continues to build up an impressive ARR base, and as companies continue to focus on the advantages of automation and AI, Splunk's focus on mining machine data for actionable insights will continue to enjoy secular tailwinds. On top of making short-term trades for quick gains (Splunk has been volatile on a day-to-day basis over the past month), I am still holding onto a good chunk of Splunk stock in my portfolio. In my view, there's plenty of rope - especially from a valuation standpoint - for Splunk to charge higher. This machine-data software company is up ~15% year to date, on par with the S&P 500 but lagging behind many small/mid-cap software companies that have seen sharp rallies since the start of the year. Splunk ( NASDAQ: SPLK ) is a great name to look into. Amid double-digit gains in the stock market this year, many investors may be thinking: is there still room to rally higher? In my view, the answer is yes, but careful stock selection is the key.

0 kommentar(er)

0 kommentar(er)